2020 Annual Review: Resourcing the future of anaesthesia

Resourcing the future of anaesthesia

"The College's Finance and Resources team reflect on a year of COVID-19, including budgets, sustainability and investment in technology."

The College reported in its 2019-20 accounts a net reduction in the value of College funds of £1.6m (10 per cent), making the College net worth £32.4m. Like other organisations, the College has been severely impacted by COVID-19, for both its operational activities and investments.

Despite this reduction, the College Trustees and our external auditors continue to view the College as a going concern. To put this negative movement into context, the College’s revised net worth still exceeds that of June 2017. This means we can continue to pursue our charitable aims of training, research and education for the benefit of our membership and the public.

For further details see the summarised financial statements in this review or visit our website for the full set of accounts.

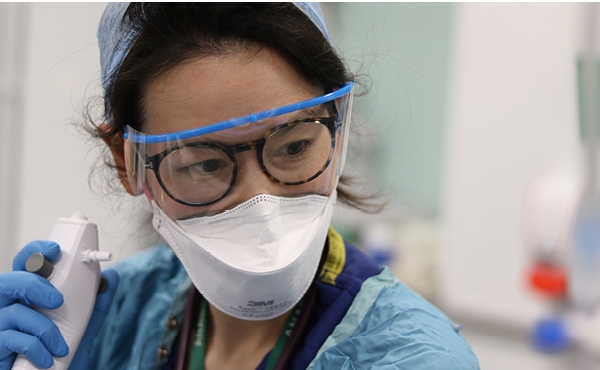

Impact of COVID-19

The impact of COVID-19 is shown across a significant amount of our activities and has been reported in previous sections of this review. The main areas of College work affected were exam delivery, event delivery and non-charitable trading.

During the spring of 2020, we cancelled two clinical exams and a series of events, including Anaesthesia 2020. We pivoted during the second half of 2020 to successfully deliver virtual exams and events.

Some of our trading activities were severely impacted by COVID-19 and we will look to restart these, including renting space in our estate to other medical organisations, as soon as we can.

There was severe market turbulence during early 2020, with the College reporting significant investment losses in our accounts. These losses were being steadily recouped by our investment managers as the economic situation recovered during the latter half of the year.

The impact of COVID-19 is shown across a significant amount of our activities and has been reported in previous sections of this review.

Technology

We have now completed our multimillion-pound technology programme.

The highlights of this three-year programme were:

- creating our own bespoke Lifelong Learning platform that integrates an e-portfolio, logbook, CPD diary and offline functionality

- developing new websites for the College, the Faculty of Pain Medicine and the Centre for Perioperative Care which we believe offers a better experience both for our members and the public.

One of the final pieces of work under our technology programme was implementing a new Customer Relationship Management (CRM) system that allows us to better understand and support our membership. This launched at the end of 2020.

To maintain the benefit of these developments, the College will have to continually invest in technology to make sure that it remains up to date and easy to use.

So, in the coming year we will be developing:

- single sign on across our multiple digital platforms

- rolling out the College Lifelong Learning platform to FICM

- launching a new examination management system.

Value for our learners

The College does not make a surplus from the provision of examinations and training courses to our membership. We monitor this annually and can confirm that this was the case for 2019-20 and that we have set a budget with the same aim for 2020-21.

Sustainability and the environment

The College is committed to embedding sustainability in everything we do. From the launch of the College’s Sustainability Strategy in 2019, 2020 saw the furthering of the College’s ambitions to minimise impact on the environment, both in clinical practice, where anaesthetic gases account for five per cent of the carbon footprint of acute organisations, and through the workings of the College. The sustainability strategy comprises a number of strands.

Reviewing College investments to ensure they are consistent with our aim to be a socially and environmentally responsible organisation

Our investment advisors select investments to generate College income whilst also recognising that we want to invest responsibly.

In terms of exclusions, the College has for years not invested in tobacco.

In addition, in 2020, the Board of Trustees made a commitment to divest from fossil fuel providers within two years, if the College and its investment managers were not satisfied that their business model aligned with the UN Paris Agreement on climate change. This agreement seeks to limit global warming to 1.5 degrees Celsius compared to pre-industrial levels.